Agricultural/ Farm loan waiver first introduced by UPA government in 2008 is again in news particularly after the loan waiver by UP government in 2017. Since then more and more states, under the stress of farmers protests and political motives have followed the suit like Punjab, Rajasthan, Maharastra and the latest one being Karnataka. The Karnataka government has decided a partial loan waiver of about ₹ 34,000 crores in its 2018-19 budget.

Agriculture and its Current Problem –

With 54.6% of Indian of Indian population engaged in agriculture which contributes 17% to the country’s Gross Value Added (current 2015-16, 2011-12 series), it holds great importance to our economy as well as the to the society. According to India spend, analysis of various government data nearly 70% of India’s 90 mn agricultural households spends more than they earn average each month. A bad harvest as well as a good harvest ( since farmers have to sell foodgrains at a very low price because of lack of proper reach to market and lack of storage facilities) both leads to Farm Debt and hence the demand for farm loan waiver. The main issues of Indian Agriculture which in result leads to farm debt and hence the demand for farm loan waiver can be summarized under following heads:

1. Small landholding –

The Gross Cropped Area (GCA) 195 mn hectares and a Net Sown Area (NSA) 141.2 mn may sound huge, but when we look at the data of the size of landholdings it becomes an issue to worry. According to 2011 census, 67% of Lanholdings are classified as Marginal (less than 1 hectares), 18% are classified as small landholdings (between 1-2 hectares ) and large landholdings ( more than 10 hectares ) were estimated only about 0.7%. Thus the low average size of landholdings results in low agricultural productivity.

2. Lack of Irrigation facilities –

Although being the second largest irrigated country after China, about 65.3 mn hectares i.e., only one-third of the cropped area is under irrigation. It means most of the farmers are depended on good monsoon for their good harvest and when it fails, it leads to farm debt, suicides and demand for loan waiver.

3. Lack of Mechanization –

Since most of the agricultural operation in large parts of India is carried by humans using simple machines like wooden plough, sickle etc. Thus a large amount of labour is involved in agriculture than required creating the situation of disguised unemployment.

4. Lack of Agricultural Marketing –

The absence of agricultural markets in rural India forces farmers to sell their grains at a throw-away price to the local middlemen and traders. Thus they profit shrinks and many times they are also in the loss.

5. Inadequate Storage facilities –

Inadequate availability storage facility provided by FCI, Central Warehouse Corporation (CWC) and State warehouse Corporations (SWC) in Rural areas force farmers to sell their grains immediately after harvest, and since prices are very low at the post-harvest time farmers are indebted in loans.

6. Inadequate Transport Facilities –

Because of lack of transport facilities and rural infrastructure, many farmers are not able to reach to the urban markets to sell their crops.

7. Scarcity of Capital –

The main money supplier to landless labour and marginal farmers are moneylender, traders and commissioned agents since it is still difficult for them to take loans from the bank. These people charge a very high interest from the farmers which entraps them in a vicious cycle of poverty.

Why is Loan waiver not the solution?

- RBI has pointed out that farm loan waiver is going to hurt the finances of the states. This will further worsen the financial condition of states.

- A promise of farm loan waiver during elections will create a moral hazard since farmers will take loans and will not pay knowing that loans will be waived in near future by the government.

- Farm loan waivers will weaken the credit discipline in the country. Those who had paid loans by working hard will find themselves fooled since those who didn’t pay will get the benefits of it. Also, the NPAs of banks in agriculture is rising due to the farm loan waiver.

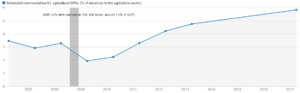

NPAs in Agriculture have risen after large-scale loan waiver in India in 2008.

- It discriminates against farmer taking the loan from private sources. Since most of the landless labours and marginalized farmers take a loan from the local moneylender, loan waiver mostly benefits large farmers.

The above graph depicts the percentage of institutional loans in India. A total of average 60% loans taken farmers in India are institutional loans ( i.e., loans by banks, cooperative societies or government), also this is very low about 30% for the poor states like Bihar and Jharkhand. Thus farmers in these states will not benefit much from loan waivers.

- If this process of farm loan waiver will continue in future then banks will brand farm loans as bad loans and will implement stricter rules to lend money to farmers.

- Farm loan waiver generally excludes landless labourers who are even weaker than the cultivators in bearing the consequences of economic distress.

Farm Loan waiver is only a small part of banks –

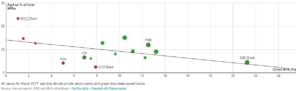

Supporters of Farm loan waiver argue the small number of agricultural loans when compared to a proposed haircut on Bank NPAs mostly due to industrial groups. For example, UP loan waiver is just above 36,000 crores when compared to 5.7 lakh crores owned by the top 10 corporate groups.

Read more – Is Indian Foreign Policy Under Modi Government Effective?

The above graph shows that agriculture loans are only a small part of banks total bad loans.

Farmer movement attacks the arguments given against farm loan waiver as Hippocratic. According to them where was this moral outcry when Manmohan Singh government in the year 2009 gave a bailout package of a mammoth amount of ₹ 3 lakh crores to Indian industries in anticipation of a possible effect of the global slowdown.

Since about 82% of all farmer indebted are small and marginal farmers, farm loan waiver is an immediate relief for them if not a solution.

Many farmers who borrow money from moneylenders will borrow money from public banks after the farm loan waiver. Thus this will help in their financial inclusion and will also have to pay less interest on their loans.

Farm loan waiving can be an immediate relief but is not a permanent or long term solution to the problems of agriculture. Also, the argument about the bailout to industries doesn’t hold water since two wrongs cannot make a right.

Read more – Is The Economy Of India Doing Better Under Modi?

A solution to the problems of farmers lies in providing cheap institutional credit at easy terms particularly to marginal and small scale farmers. The existing schemes of crop insurance, Kisan credit card, and various other incentives should be given with transparency as most of these benefits are taken by the large farmer. Also, rural infrastructure should be developed and Storage godowns should be constructed in rural areas to provide storage facilities to the farmers after harvest. At last but not the least proper implementation of MSPs should be done by the government so farmers could get their due price to maintain their living.