Once upon a time in ‘Bharat’

Amanjeet and Amarjeet were two farmers who took a loan from nearby branch of their state co-operative bank, for sowing. Year later after the harvest Amanjeet repaid it with full interest, where Amarjeet waited and waited evading the fiery notices of the bank to sell the mortgaged. And yeah finally his patience beared fruit, it was the time for the biggest electoral carnival of his state, Assembly Elections. Mobiles,electricity,utensils, bicycle, laptop and of course ‘Farm Loan Waivers’ (and also the fiscal deficit) were overflowing in the manifestos. And yeah finally the day arrived new sworn in Chief Minister announced the Farm Loan Waiver package of 30,000 crore, and sitting in a ‘Desi’ liquor bar Amarjeet boasted to his friends how he managed to fool the system, and get awway without without paying single penny.

The aforementioned anecdote was a work of realistic fiction, real things happenings explained through a fictional story. Wilful Credit defaulters-Mallya,Choksi, Nirav-these are the names which comes to our mind 8000-10000 crores of rupees defrauded from the Indian banking institutions through loophole, but if you look from a bankers point of view ‘MP CM announced 36,000 crore waiver, UP CM announced 37,000 crore waiver’ these headlines too freeze their nerves. Credit creation is one of the basic functions of the bank but further follow-ups for its timely recovery is extremely essential. When a Government waives a loan it means it instructs a bank that we will pay the debt which you have extended to the farmers for agricultural and allied activities. Things look fine till now but When? That’s unspecified. Whenever they have money or they feel like paying it back.

Does Farm Loan Waivers actually help?

When news of the NPAs breaks out, self proclaimed socialist,activist shouted out how crooked these politicians are who allow of crores of rupees to be routed and provide umbrella to the riches where our poor farmers are committing suicides over loan repayment, and the opposition hammers government for being pro-business and the Government under pressure declares populist measure of farmers loan waivers. Interesting thing is now days such measures even win elections! Interesting point to note with respect to such cases is according to a survey only 2.65 % of the total farmers suicides were accredited to debt related cases. Leading in the list was failure of crops which forced 16.84% of farmers to commit suicide.

Causes of suicide Percentage `

| Other reasons | 15.04% |

| Family problems with spouse | 13.07% |

| Debt Burden | 2.65% |

| Losses in Non farm activites | 1.77% |

| Failure of crops | 16.84% |

| Failure of borewell | 0.88% |

| Political Affiliation | 4.42% |

Till 2017 Governments have spent whooping 1.7 billion USD on Loan Waivers. When such populist measures are announced, targeted group should be benefitted but according to a recent NITI Ayog study just 10-15% benefitted from the declared loan waivers. Main reason behind this farmers just don’t borrow from banks. 80% of our farmers fall into small and marginal category who owns less than 2 acre of land, and are exposed to debt-trap still prefer unconventional sources like moneylenders as their source of finance, which are not covered under the Loan Waivers. Another reason being, two previous national Loan Waivers which were announced in 1990 and 2008 respectively banks have noted the defaulting farmers and they refuse to extend them further credit, thus forcing them to go for moneylenders.

Institutional problems with Agricultural Sector

Nobel laureate Amartya Sen in an interview explained how Loan waivers provided temporary relief to the farmers and is not as vile as some refer to it but waiving farmers loan, mounting burden of NPAs to already fragile banking system is nothing much but just passing the buck. In last 10 years Agriculture related NPAs have increased from 6.40% to 11.4%. This year in Rajasthan Gopal*,resident of Govadi got a message from agricultural co-operative society claiming that he’s father’s farm loan was waived. Intriguing part is he hadn’t taken a loan. Similar thing happened with around 3,000 farmers of DUngarpur district. Currently under investigation the scope and reach of this scam is unknown.

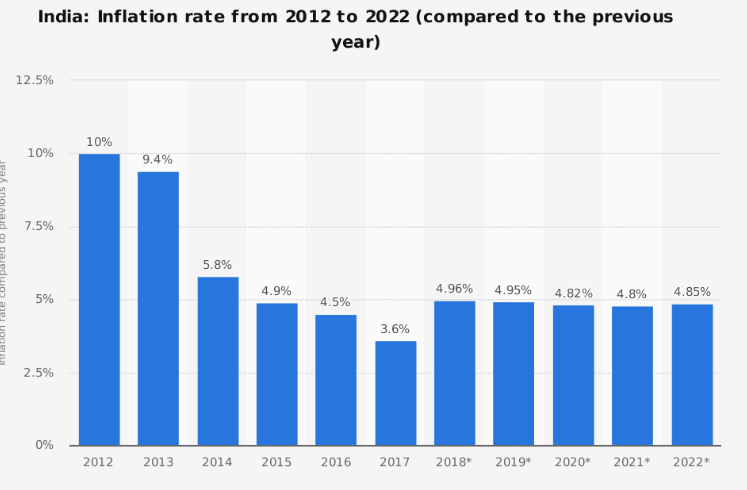

In Order to understand why this need of Loan waiving began in first place one needs to look deeper into agrarian crisis. While chests are being thumped about doubling farmers income ground zero data points the other way. MSP being declared for 23 crops, where Government paying 1.5 times the market price only 6% of the total farmers were able to sell their produce at MSP. In a survey conducted by NITI Ayog 79% of the farmers expressed their dissatisfaction for the declared MSP. Last 27 months were phenomenal years for consumers as inflation of food index remained checked below 4% it was a catastrophe for the agricultural sector. Low prevailing market prices were result of record high production of grains (for eg pulses production jumped from 16.31 metric tonnes to 23.13 metric tonnes) and accompanied by unchecked imports(6.6 metric tonnes of pulses were imported) law of demand and supply, less demand and more supply price of the commodity decreases.

Alternatives to Loan Waivers

Orissa Government has declined to waive loans standing against the tide and has declared an ambitious scheme for farmers called Kalia, which stands for ‘Krushank Assistance for Livelihood and Income Augmentation.’ Scheme includes assistance of INR 25,000 per farm family to purchase inputs, insurance cover, assistance to landless farmers. Given the length and breadth of the state and abridgement of economic development it’ll be a challenge for Patnaik to implement it, nonetheless a better to bank on rather than freebies.

The fault lines of this crisis lies within the system. Instead of going for veracious, foresighted solution to this chronical problem our leaders have always looked out for clinical dressing rather than surgical treatment. And one such story of our vote-bank centred political system is Farm Loan Waiver.